Stripe is one of the most popular payment solutions in today’s market. It boasts easy integration, custom APIs, support for subscriptions and recurring payments, fraud protection, and more.

It's a top choice for businesses seeking a versatile and secure payment solution. In fact, BuiltWith data indicates that over 1.5 million live websites use Stripe.

However, while Stripe is a leader, it isn’t necessarily ideal for every business. That's why it’s important to explore the best Stripe competitors to understand the key players in the industry.

This way, you’ll also have more data to make an informed decision about which payment processing platform fits your business.

We’ve compiled a list of the top 13 Stripe alternatives, including key features, pros and cons, and potential money-saving avenues.

Let’s get started.

How We Chose the Best Stripe Competitors

We evaluated these Stripe competitors based on the following factors:

- Key Features: We examined the range of tools they offer beyond payment processing. This includes subscription billing, invoicing, reporting, POS solutions, and more.

- Usability and Integration: We assessed how easy each tool is to use and implement into your existing systems. We considered factors like detailed documentation, APIs, and support during onboarding.

- Pricing: We compared the costs associated with each platform’s services. We focused not only on the value they deliver but also on competitive, transparent, and predictable pricing.

- Customer Support: We evaluated support options before, during, and after onboarding. Availability, responsiveness, and channel choices are important.

- Customer Reviews: We gathered data on user experiences to understand the platform’s strengths and weaknesses. High user ratings and positive feedback signify a positive user experience that increases customer retention and loyalty.

13 Best Stripe Competitors Worth Your Time

Although Stripe is a popular payment processor, reviewing alternatives like these 13 Stripe competitors may be better suited for your business needs and budget.

Keep reading to compare key details and make an informed choice.

1. Verifone

Image via Verifone

Verifone (formerly 2Checkout) is among the Stripe competitors specializing in global payment processing for companies selling digital goods.

It supports major cards, popular digital wallets, and over 45 localized payment methods. Its coverage spans over 200 countries (against Stripe’s 46) and 100 currencies. It also includes multi-language support.

Verifone offers billing and subscription management. Not to mention, the platform has customized checkout experiences and can adapt to fit business needs.

Verifone is an all-in-one solution offering payment gateway and merchant account options that help you scale your ecommerce business.

Key Features

- Localized checkout in 30+ languages

- Supports 100+ currencies, 200+ markets, and 45+ payment methods

- Recurring billing and subscription management

- Security and compliance features like PCI DSS, MFA, modern fraud protection, and more

- Email and chat support

Pros

- Extensive international reach

- Designed for companies selling digital goods

- Offers several add-ons to enhance your for managing headless ecommerce

- Multilingual checkout

Cons

- No in-person payment processing

- Potentially higher transaction fees

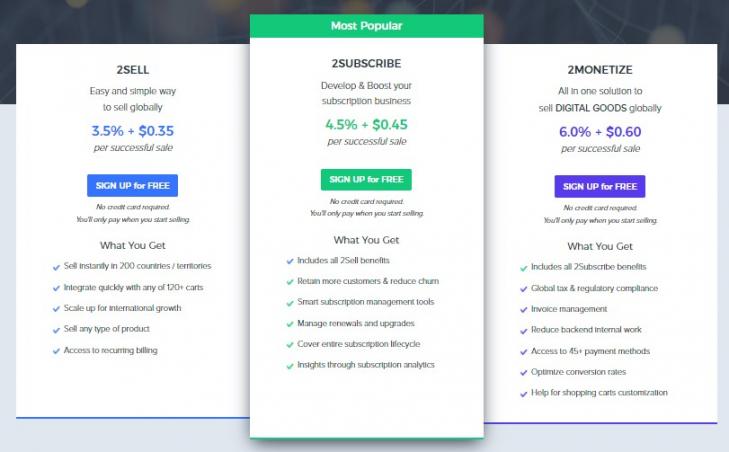

Pricing

Verifone offers four plans depending on your business requirements:

- 2SELL: 3.5% + $0.35 per successful sale

- 2SUBSCRIBE: 4.5% + $0.45 per successful sale

- 2MONETIZE: 6.0% + $0.60 per successful sale

- 4ENTERPRISE: Custom Pricing

Image via Verifone

Tool Level

- Intermediate

Usability

- Easy to integrate and use

Pro Tip: Head to Verifone Central to view your payment history and manage all your transactions from every payment method.

2. PayJunction

Image via PayJunction

Stripe competitors like PayJunction offer payment processing for in-person and online transactions. It’s a payment gateway and merchant services provider with multi-channel payment processing.

Its smart terminal supports EMV, contactless payments like Apple Pay, and magstripe cards. It also accepts all major credit cards and ACH transfers. You also get recurring billing and subscription management.

PayJunction provides several features in a unified platform, helping your business thrive and scale.

Key Features

- Interchange-plus pricing

- Robust ecommerce and mobile tools

- Call, online form, knowledge base, and email support

- Virtual terminal

- Free payment gateway

- Recurring billing and invoicing

- Security measures like PCI DSS compliance, TSL certifications, and others

- Mobile app for iOS devices

- No-code Payments Integration™

Pros

- No monthly, annual, or exit fees

- Straightforward interchange-plus pricing

- Knowledgeable customer support team

Cons

- Limited global availability

- Lacks some advanced features

- Unsuitable for high-risk industries

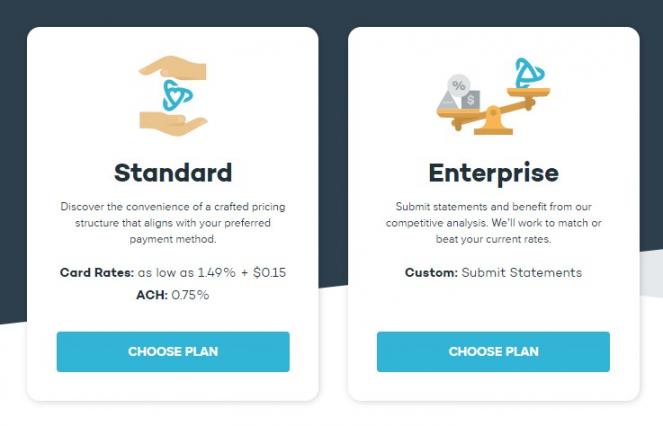

Pricing

PayJunction has two tiers:

- Standard: 1.49% + $0.15 for card transactions and 0.75% for ACH

- Enterprise: Custom pricing

Image via PayJunction

Tool Level

- Intermediate

Usability

- Easy-to-use interface, but customization requires some developer skills

Pro Tip: Make sure to integrate PayJunction with your existing accounting software to keep your financial records organized and up-to-date.

3. Adyen

Image via Adyen

Adyen is an end-to-end global payment processor. It’s a multichannel payment platform that allows you to receive ecommerce, mobile, in-store, and POS payments. It also offers merchant accounts and a payment gateway.

Of all Stripe competitors, none unifies data across in-store, online, and in-app transactions like Adyen. It calls itself a “financial technology platform for the modern era.”

It gives you access to 150+ payment methods, including credit cards, ACH transfers, digital wallets, and localized payment methods.

Key Features

- Unified commerce data and reporting capabilities

- POS and terminal solutions

- Recurring billing and subscription management

- API and plugins for easy integration

- Customer support via ticket requests, FAQs, and knowledge base

- Payment gateway supporting 150+ payment methods and 180+ currencies

Pros

- Unifies data across sales channels for improved customer experience

- Offers POS and terminal solutions to facilitate in-person payments

- Broad global payment reach in almost 100 countries

- Sophisticated data analytics and reporting for ecommerce marketing strategy

Cons

- Less suitable for simple integrations

- Understanding its pricing can be a bit tricky

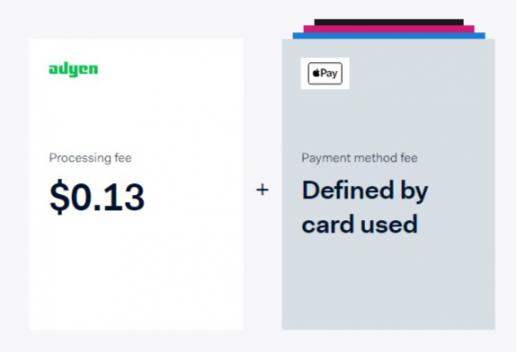

Pricing

Like several Stripe alternatives, Adyen uses an interchange+ price model:

- $0.13 fixed processing fee + interchange

Images via Adyen

Tool Level

- Expert

Usability

- Powerful but complex, suited for larger technical teams

Pro Tip: Enable the ‘1-Click’ feature by adding a payment field in your customers’ profile and saving their payment data. Customers will only need to click the pay button once to complete their transaction.

4. Younium

Image via Younium

Younium is among the top Stripe competitors that simplify subscription management. It’s an all-in-one tool that streamlines the full lifecycle of customer subscriptions.

Removing the need for spreadsheets and manual processes, Younium allows businesses to automate billing, manage complex subscriptions, and ensure tax compliance.

Younium enables accurate financial reporting and revenue recognition. It also supports various pricing models and flexible billing schedules. A SOC 2-compliant ecommerce marketing strategy, Younium integrates seamlessly with your tech stack for improved efficiency and a seamless workflow.

Key Features

- Rule-based revenue recognition for compliance

- Tax compliance

- Automated recurring and usage-based billing

- Multi-company, multi-currency subscription management

- Accurate, timely reporting on revenue and sales metrics like monthly recurring revenue, churn rates, and more

Pros

- Provides real-time subscription metrics reporting to fast-track audits

- Easily expand your business globally with its multi-currency system

- Can seamlessly handle customer-initiated changes like add-ons, renewals, or plan upgrades

- Offers quote-to-cash process for more control and fewer errors

Cons

- Some features may be too much for small businesses or startups

- May encounter difficulties syncing with legacy systems

Pricing

The website doesn’t provide pricing information. However, you can fill out a form to request a demo and quote.

Tool Level

- Beginner to Advanced

Usability

- Straightforward interface, but some advanced features may require a slightly steeper learning curve

Pro Tip: Take full advantage of Younium’s custom dashboards and real-time reporting tools to closely monitor key subscription metrics like MRR (Monthly Recurring Revenue), churn rate, and customer retention.

5. Square

Image via Square

Square is among the best Stripe competitors tailored towards retail, restaurants, and mobile businesses. It’s known for providing integrated solutions for payment processing and point-of-sale needs.

The platform offers easy-to-use POS software and hardware to facilitate smooth in-person payments. It’s also one of the best SaaS billing software, making online payments simple by accepting major cards. It also provides contactless payment options like Apple Pay, contactless cards, and ACH transfers.

You also get tools to manage recurring billing, invoicing, inventory management, and loyalty programs as a part of your customer retention strategy. Additionally, you can enjoy instant deposits and predictable pricing with no monthly fees.

Key Features

- Free, user-friendly POS systems with integrated payments

- Omnichannel payment processing

- Security and compliance with PCI DSS, risk management, fraud protection, and more

- Inventory management, loyalty programs, and POS integrations

- Instant deposits without any monthly fees

- Knowledge base, live chat, and phone support

Pros

- Robust POS and payment management

- Affordable pricing

Cons

- Limited customization and developer options

- Complex pricing for advanced features

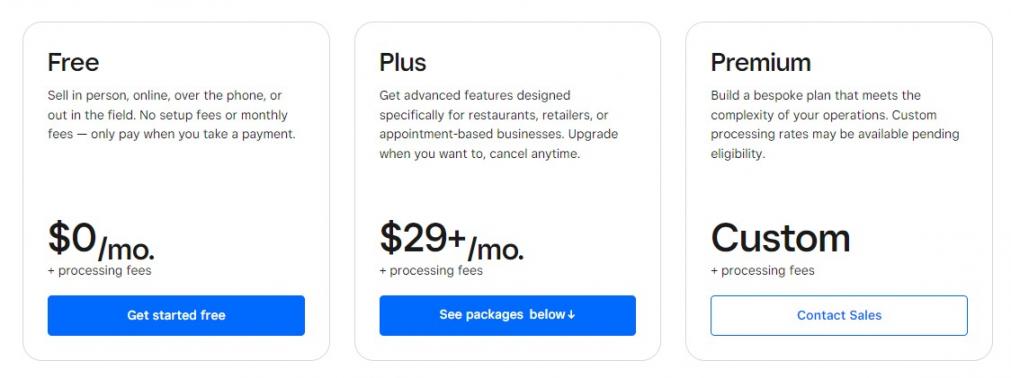

Pricing

Square plans typically charge processing fees – either in person, online, card, or invoice transactions. The plans include:

- Free: $0/month + processing fees

- Plus: $29/month + processing fees

- Premium: Custom pricing + processing fees

Image via Square

Tool Level

- Beginner

Usability

- Easy to use with an intuitive interface

Pro Tip: Leverage the Square Customer Directory to boost customer relationships.

6. Intuit QuickBooks Payments

Image via Intuit QuickBooks

You can combine QuickBooks Payments with your QuickBooks accounting system to create an integrated accounting and payment platform.

That’s why it’s becoming notable among Stripe competitors. It automates payment tracking, invoicing, and receipts organization. It also supports in-person, online, and on-the-go payments.

Furthermore, QuickBooks Payments accepts all major credit and debit cards, bank transfers/ACH, and digital wallets like Apple Pay. You’ll get card readers for chip, tap, and contactless transactions to smoothen in-person payments.

Key Features

- Tight integration with QuickBooks’ accounting solution

- Mobile card readers for in-person payments

- Online payment acceptance

- Security via PCI DSS compliance, MFA, TLS, and more

- Invoicing and recurring billing

- Free GoPayment mobile app for iOS and Android

- Customer support via call, online community, and contact form

Pros

- Unified upfront payments and accounting

- Familiar interface for QuickBooks users

- Reasonable rates for in-person transactions

Cons

- Limited flexibility beyond the QuickBooks ecosystem

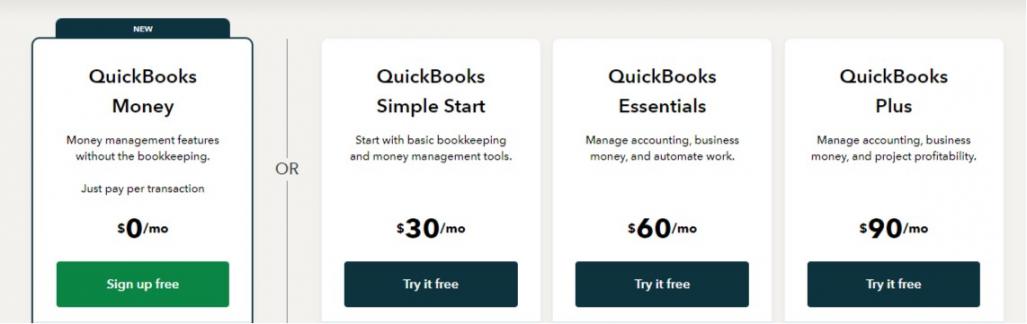

Pricing

If you just need to accept payments, the free QuickBooks Money plan provides money management features and allows paying per transaction. Other plans add an accounting component.

- QuickBooks Money: Free

- QuickBooks Simple Start: $30/month

- QuickBooks Essentials: $60/month

- QuickBooks Plus: $90/month

Image via Inuit QuickBooks

Tool Level

- Intermediate

Usability

- Easy to use

Pro Tip: To resolve a deposit error, just delete and recreate the payment. You don’t need to reprocess the card.

7. PayPal Braintree

Image via PayPal Braintree

PayPal Braintree is another of Stripe's competitors, offering a payment gateway and merchant account for added control and customization.

The platform supports several payment methods, including major credit cards, PayPal, Apple Pay, Google Pay, Venmo, and local payment methods. Thus, if you are starting a website, PayPal can be a reliable source.

PayPal Braintree partners with PayPal's Zettle readers to help you handle in-person payments.

Key Features

- Merchant accounts

- Customizable payment gateway

- Recurring billing and subscription management

- Fraud protection, PCI DSS compliance, and other security measures

- Seamless PayPal integration

- Online contact form, call, and email customer support

Pros

- Flexible custom payment flows

- Robust recurring billing capabilities

- Extensive international support, providing support for over 130 currencies

- Comprehensive security and fraud prevention

Cons

- Potentially longer onboarding process

- Reports of poor customer service

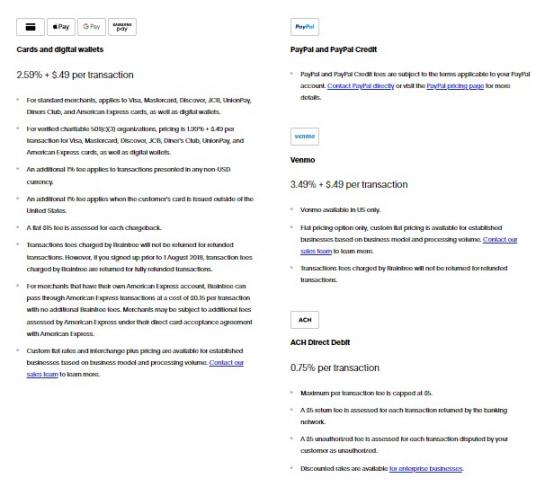

Pricing

PayPal Braintree provides predictable fees for various payment methods:

- Card and digital wallets: 2.59% + $0.49 per transaction

- Venmo (US only): 3.49% + $0.49 per transaction

- ACH Direct Debit: 0.75% per transaction

- Custom pricing is also available

Image via PayPal Braintree

Tool Level

- Intermediate/Expert

Usability

- Fairly easy to use but has a complex integration process

Pro Tip: Maximize your reach by leveraging PayPal Braintree’s multi-currency and multi-payment method capabilities.

8. Payoneer

Image via Payoneer

Payoneer is among the best Stripe competitors for small businesses, freelancers, and contractors. It allows you to send and receive payments without a merchant account.

However, direct billing isn't possible. Instead, you request payment on the platform and wait for customers to send funds.

You can then withdraw the funds to your bank account or use the Payoneer debit card for ATM withdrawals.

Key Features

- Local bank transfers in 100+ countries

- Multi-currency support

- Payoneer debit card for global ATM access

- Security via PCI DSS and AML/CTF compliance, RSA adaptive authentication, and more

- Seamless integration with various marketplaces and ecommerce platforms

- Customer support via mail, email, live chat, phone, and contact form

Pros

- Supports a wide range of payment methods and currencies

- Competitive foreign transaction rates

- Customer support by email, phone, contact form, and live chat

- International payment options

Cons

- Doesn’t offer a payment gateway, virtual terminal, or POS capabilities

- Doesn’t integrate with card readers, so no in-person card payments

- Withdrawal and registration fees apply in certain regions

Pricing

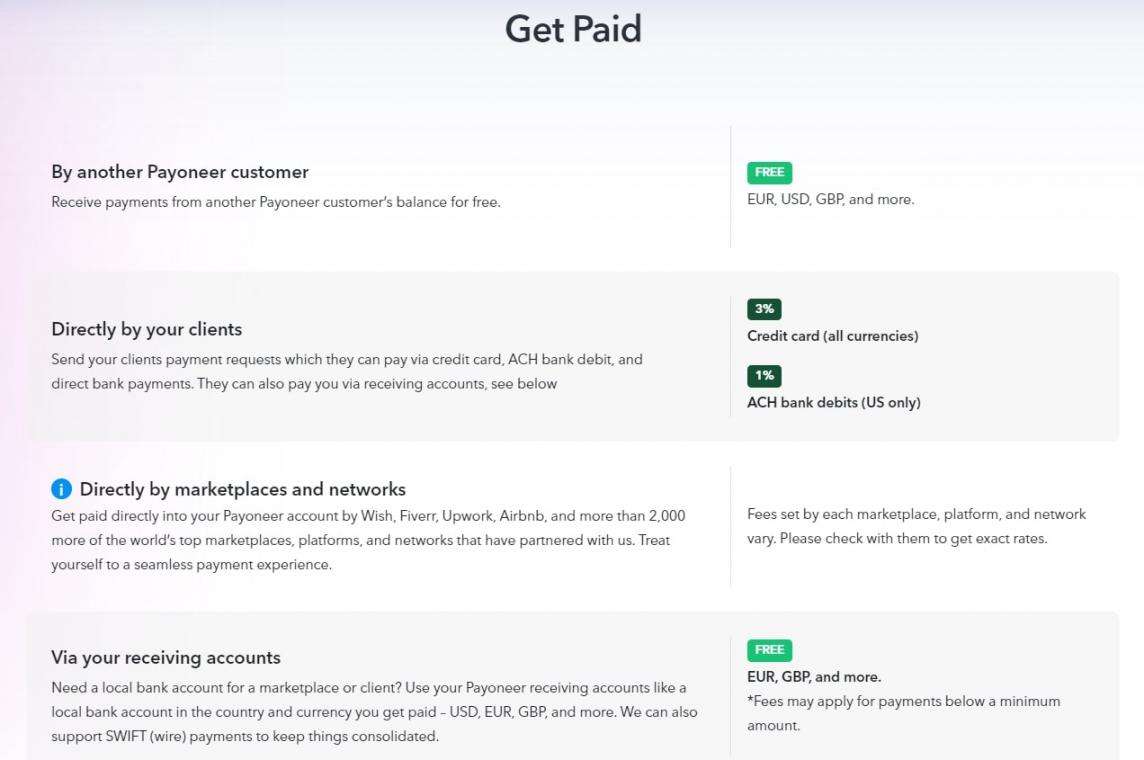

Here are the fees associated with Payoneer:

- 3% for credit card transactions

- 1% for ACH bank debits (US)

- 0% from other Payoneer users

Image via Payoneer

Tool Level

- Intermediate

Usability

- Simple signup process but advanced features require technical skills

Pro Tip: Take advantage of Payoneer's ability to receive payments in multiple currencies and withdraw funds to your local bank. This minimizes conversion fees and expedites access to your earnings.

9. Authorize.net

Image via Authorize.net

Authorize.net is another stripe competitor that offers a payment gateway and merchant account services, supporting 130+ currencies.

It supports major credit cards, debit cards, e-check payments, and digital wallets like Apple Pay. You can also manage recurring billing for subscriptions, digital invoicing, and POS.

The platform lets you choose between an all-in-one option with a merchant account included or gateway-only if you already have a merchant account.

On top of that, Authorize.net offers plugins for easy ecommerce integration with multiple ecommerce tools and a user-friendly dashboard for simple payment management.

Key Features

- Automated recurring billing

- Advanced Fraud Detection Suite (AFDS) with 13 fraud filters

- Shopping cart plugins for easy integration

- Mobile payment processing

- Customer Information Management (CIM)

- Online chat, support case, or phone customer support

- Digital invoicing

- POS integration

Pros

- Ideal for businesses with shopping carts

- Excellent customer service reputation

- No setup fee

- 24/7 customer support through online form, phone, and chat

Cons

- Monthly minimum limits apply for small businesses

- Limited omnichannel payment processing

- Added charges for additional features

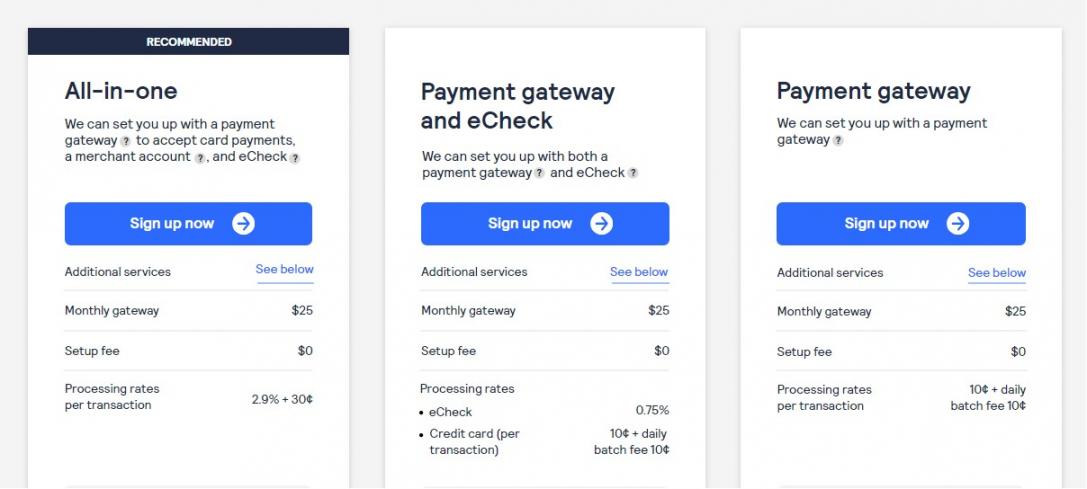

Pricing

Like other Stripe competitors, Authorize.net offers several tiers, all with a $25 monthly gateway:

- All-in-one: 2.9% + $0.30 per transaction

- Payment gateway and e-check: $0.10 + $0.10 daily batch fee for credit card transactions and 0.75% for e-check

- Payment gateway: $0.10 per transaction + $0.10 daily batch fee

Image via Authorize.net

Tool Level

- Beginner/Intermediate

Usability

- Straightforward setup but extensive features require training

Pro Tip: Activate your Payoneer Commercial Mastercard® to unlock higher daily spending limits and access multiple digital cards.

10. Helcim

Image via Helcim

Helcim is a viable option for those running a small or medium-sized business or looking to start an ecommerce business. Among the Stripe competitors on this list, this payment processor has a relatively low cost.

It offers secure payment processing paired with excellent customer service for better customer retention and competitive interchange-plus pricing.

Most importantly, you’ll get a payment gateway and merchant account combined into an all-in-one advanced solution.

The platform supports all major credit cards, debit cards, digital wallets, and ACH bank-to-bank transfers.

Key Features

- Interchange-plus pricing

- Free virtual terminal, payment gateway, POS integration, and invoicing tools

- Free recurring billing, subscription, and invoicing tools

- EMV and NFC processing

- Level 2 and 3 data processing

- Phone, email, and chat support

- Security via secure card vault, PCI DSS, Firewalls and Intrusion Detection and Prevention Systems (IDS/IPS), and more

Pros

- Great customer service reputation

- True interchange-plus pricing

- Free payment gateway, virtual terminal, POS integration, and invoicing tools

- Free for charities

Cons

- Mostly geared towards Canadian and American businesses

- Deposits take two business days

Pricing

Here are the costs involved in Helcim, depending on the payment method:

- In-Person: 1.93% + $0.08 per transaction

- Keyed & Online: 2.49% + $0.25 per transaction

- PIN-Debit Rate: 1.01% + $0.08 per transaction

- Custom pricing is also available

Image via Helcim

Tool Level

- Beginner

Usability

- User-friendly dashboard and simple integration

Pro Tip: Save up to $500 on processing fees by switching to Helcim from another provider.

11. PayPal

Image via PayPal

Of all Stripe competitors, PayPal is perhaps the most well-known. It can handle online payments via credit and debit cards, and digital wallets like Apple Pay and Google Pay. It also accepts payments through online ACH/bank transfers and crypto, including PayPal USD, Bitcoin, and more.

You can sign up for a PayPal merchant account that accepts major credit and debit cards, PayPal balances, bank transfers, and more.

This account has handy features, including invoicing and payment processing tools. It also allows integration into existing payment systems and websites, regardless of which website builder was used. This distinguishes it from personal PayPal accounts.

Key Features

- Seamless integration into websites and shopping carts

- Checkout optimization for mobile and web

- Recurring billing and invoicing capabilities

- Mobile app for iOS, Android, and Windows

- Customer support via phone, email, chat, and community

- Security systems, including PCI DSS compliance, PayPal security key, fraud monitoring, and more

Pros

- Strong brand reputation and trust

- Smooth integration and quick setup

- Supports multiple payment methods and 25 currencies

- No monthly fees

Cons

- Customer service draws some complaints

- Relatively high merchant transaction fees

- Has a painstaking verification process

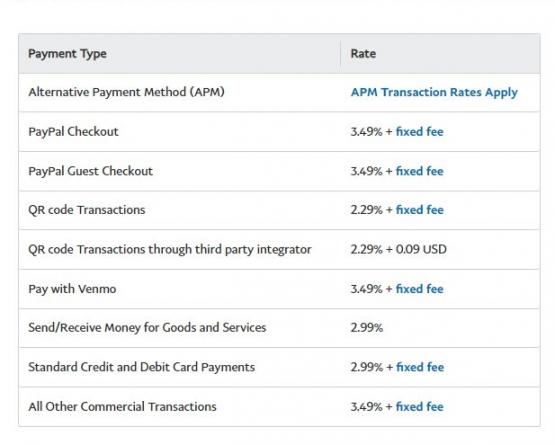

Pricing

Here are PayPal’s prices for different payment methods:

- In-person transactions: 2.99% + $0.49

- Online payments: 3.49% + $0.49

- Online credit and debit card transactions: 2.99% + $0.49

- QR code payments: $2.29 + $0.49

Image via PayPal

Tool Level

- Beginner

Usability

- Easy to use and implement

Pro Tip: Implement PayPal Checkout to intelligently present relevant payment types to your customers.

12. iATS Payments

Image via iATS

Did you know that there are over 1.5 million nonprofits in the US alone? These organizations also need a dedicated payment solution, particularly for donations.

iATS is among the top Stripe competitors designed for nonprofits. It unifies international, CDN, USD, and ACH processing and management.

Features like tailored fraud protection and the option for donors to cover transaction costs are among the reasons it outshines other Stripe competitors. Moreover, its Deluxe payment processing services allow you to create online forms and webpages effortlessly.

It's no wonder that more than 16,000 nonprofits trust iATS.

Key Features

- Brickwork, a free app that helps nonprofits process payments using Salesforce

- Global multicurrency and multipayment support

- Tailored fraud protection and PCI compliance

- Exclusive for nonprofits

- Phone, email, and FAQ customer support

- Extensive integrations

Pros

- Easy to use

- Has an option for donors to cover the transaction fees

- Ability to pre-populate online forms for recurring donors

- Doesn’t have chargeback fees

Cons

- Limited to nonprofits

- Might require a long-term contract

- Payouts in 1-2 days (Canada and the US)

Pricing

- Custom pricing

Tool Level

- Beginner

Usability

- Doesn’t require any programming expertise, so it’s super easy to use and navigate

Pro Tip: Leverage iATS Payments' pre-populated donation forms to save time for recurring donors and simplify the payment process.

13. Wave

Image via Wave

Wave is one of the best Stripe competitors designed for small business owners, freelancers, and entrepreneurs’ subscription billing management. This money management platform offers a comprehensive suite of tools to simplify invoicing, payments, accounting, and payroll.

With Wave, you can create professional invoices, accept online payments via credit card or bank transfer, and easily track primary and passive income and expenses.

Moreover, its user-friendly payroll system ensures quick staff payments. If you need help with bookkeeping and accounting, one of their expert advisors will be ready to help.

Key Features

- Customizable invoices with automated reminders

- Online payments via credit card, bank transfer, or Apple Pay

- Integrated accounting for easy income and expense tracking

- Payroll management for staff and self-payments

- One-on-one access to a team of accounting, bookkeeping, and payroll experts

Pros

- Free to use for invoicing, accounting, and receipt scanning

- Easy integration of online payments for faster transactions

- User-friendly interface designed for small business owners and freelancers

Cons

- Limited advanced features for larger businesses

- Fees apply for credit card transactions, even for the paid plan

Pricing

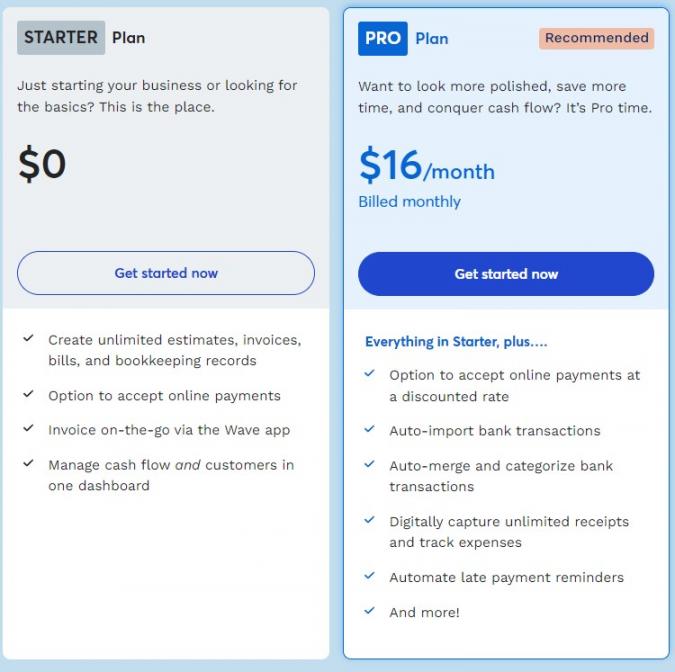

Wave offers two pricing plans:

- Starter: Free plan with limited features

- Pro: $16/month

Image via Wave

Tool Level

- Beginner/Immediate

Usability

- Simple design that’s easy to use

Pro Tip: Take advantage of Wave’s recurring billing feature to automate invoices for repeat clients.

FAQ

Q1. What exactly does Stripe do?

A. Stripe is a payment gateway and payment processor with an inbuilt merchant account. It provides a reliable and secure payment infrastructure to send and accept in-person and various online payment methods and currencies.

Q2. Who are Stripe's biggest competitors?

A. The top Stripe competitors include:

- Verifone

- Square Payments

- Helcim

- Younium

- Braintree

- Payoneer

Q3. Why should I consider these Stripe competitors?

A. You should consider these Stripe competitors because they offer:

- More unique features and tools

- Competitive pricing

- Customized solutions for specific business needs

- More global capabilities

- Easier and more integrations

Q4. Which is better, Stripe or PayPal?

A. It depends on what you're looking for. Stripe is better for developers and high-volume ecommerce sales. On the other hand, PayPal is a better fit for small businesses. It offers a user-friendly experience and broader consumer recognition.

Q5. What should I look for in a Stripe alternative?

A. Consider core features, security, ease of use, pricing, and your specific business needs when looking for Stripe alternatives. Look for a provider that offers the capabilities you require at affordable rates.

More Options for You

Stripe is an excellent payment processor for many businesses. However, it pays to explore competitors that may better serve your specific needs.

This overview of the top 13 Stripe competitors gives flexible options to choose from for your payment infrastructure.

Assess your business requirements, capabilities offered, and costs to determine the optimal payment processing partner.

Which platform do you think will better serve your needs? Tell us why below.